Dogecoin [DOGE ($0.17)] has transformed from a joke into a serious contender in the crypto market. Major financial institutions like Grayscale, Goldman Sachs, and Webull have referenced DOGE in their SEC filings, signaling increasing institutional confidence.

Memecoins are no longer just speculative plays. They are emerging as influential financial assets, with Dogecoin leading the shift.

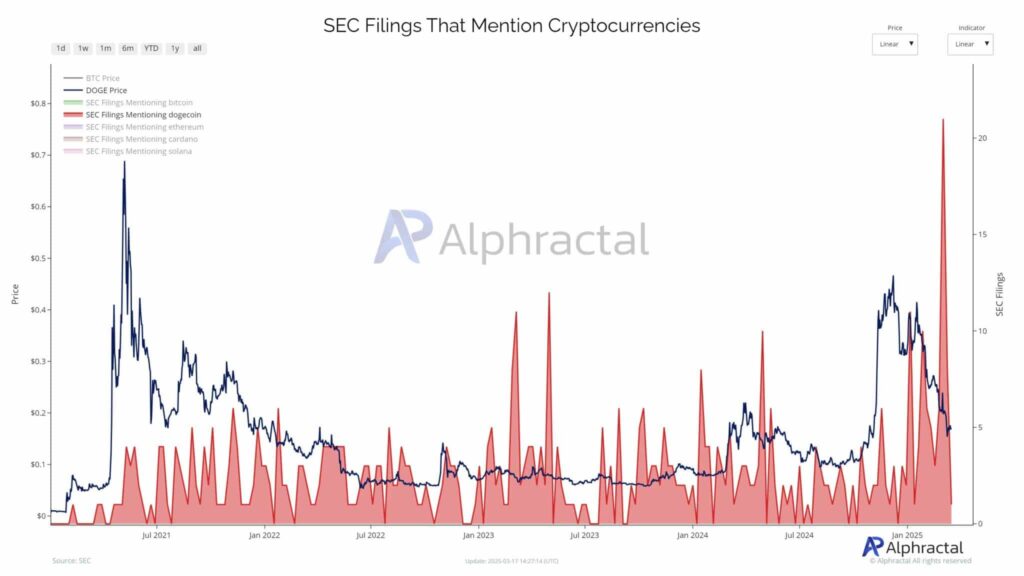

Dogecoin Sets a Record in SEC Mentions

For years, investors dismissed Dogecoin as an internet joke. However, new data from Alphractal shows Dogecoin has hit an all-time high in SEC filing mentions, surpassing many well-known altcoins.

Source| Alphractal

Source| Alphractal This development matters because institutional giants rarely reference assets unless they see long-term potential. Their recognition of Dogecoin suggests growing confidence in its market relevance.

With names like Goldman Sachs, Grayscale, and Webull Corp now publicly acknowledging DOGE, the narrative around memecoins is shifting dramatically.

Memecoins Lead the Market Shift

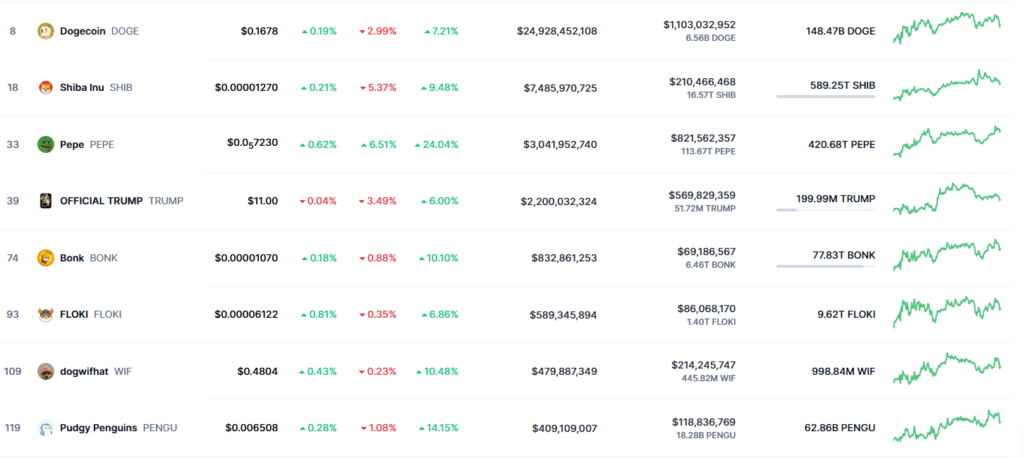

As Bitcoin loses momentum, traders are redirecting capital to memecoins. Over the past week, every major memecoin has posted notable gains, showing a growing appetite for high-reward investments.

Dogecoin recorded a 7.21% increase, maintaining its dominance in the memecoin space with $1.1 billion in weekly trading volume. Shiba Inu followed with a 9.48% gain, pushing daily trading volume to $210 million. Pepe stole the spotlight, surging 24.04% with $821 million in volume, reflecting renewed interest in smaller-cap tokens.

Source| CoinMarketCap

Source| CoinMarketCapOther memecoins also experienced strong performances. Pudgy Penguins jumped 14.15%, reinforcing demand for NFT ($0.00)-linked tokens. Dogwifhat’s market cap neared $500 million, fueled by $214 million in volume. Meanwhile, Bonk and Floki continued their steady climbs. The Official Trump (TRUMP ($11.05)) token rose 6%, maintaining high liquidity at $569 million, making it the highest-priced memecoin at $11 per token.

The consistent gains across memecoins suggest a larger shift in investor sentiment. Traders increasingly view these assets as serious market contenders rather than passing fads.

Institutions and Regulations Are Changing the Landscape

With DOGE, PEPE ($0.00), and BONK ($0.00) generating billions in volume, many speculate that memecoin-themed ETFs may soon enter the market. Institutional investors recognize these assets as high-risk, high-reward opportunities, making them appealing during bullish cycles.

The SEC recently classified memecoins as digital collectibles rather than securities. This distinction reduces regulatory uncertainty, allowing these tokens to thrive with fewer restrictions. However, authorities remain cautious about influencer-driven hype and liquidity manipulation.

Can Memecoins Maintain Their Momentum?

One thing is clear: institutions are paying attention to memecoins. Whether they see them as branding tools, trading assets, or speculative instruments, their growing involvement suggests these tokens are here to stay.

The coming months will determine if memecoins can sustain their upward trajectory or if this is another short-lived hype cycle. If institutional adoption continues, memecoins may evolve from cultural trends into legitimate financial instruments.

Read Also:Dogecoin’s Next Big Move: Will DOGE Hit $1.1 by June?

Memecoins have moved beyond their speculative origins. Dogecoin’s dominance in SEC filings highlights a major market shift. Institutional investors are taking them seriously, and traders are following suit.

The post Dogecoin (DOGE) Hits All-Time High in SEC Mentions – Is a $1 Breakout Coming? appeared first on FXcrypto News.